This is a high-risk investment and is much riskier than a savings account.

ISA eligibility does not guarantee returns or protect you from losses.

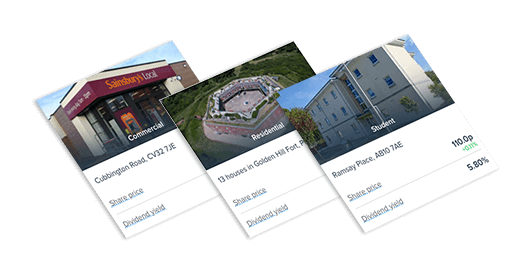

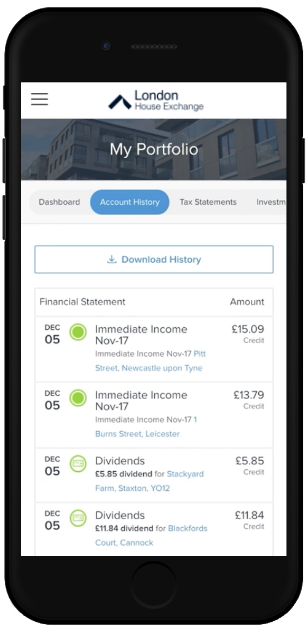

You can select your own shares in multiple professionally managed properties at the click of a button, earn dividends and sell on the exchange.

You can receive attractive returns of in excess of 8% p.a. secured directly against property assets.

Enjoy tax-free returns through our high-yielding ISA-eligible UK property-backed bonds and development loans.

We have created the world's first stock exchange for individual properties, which means you can build a property portfolio effortlessly. Invest in professionally managed properties listed on the exchange, track your portfolio and sell your shares all with a few clicks.

You can select the properties you want to invest in. Most importantly, you are in control and our exchange allows you to sell your shares in properties to other investors at a price of your choosing and track all of your investments through our app and dashboard.

Whether you want to invest for income or capital gains, prefer residential to commercial or want a mix, want to invest in equities or secured debt investments, or want to invest primarily in London or further afield, we have a vast range of properties and opportunities for you to choose from.

We employ high levels of scrutiny to properties which we list on LHX. Our level of disclosure is unmatched in the property investment market, with the regular publication of valuation reports, financial performance and selling track record for every property.

London House Exchange has been in operation and FCA regulated for over 8 years. We now have over £120m AUM, paid over £10m to clients in dividend payments, repaid 11 development loans in full with interest, returning £6.4m with an average return of 10.1% p.a., completed property sales worth £40m, and over £55m of shares have been traded on the exchange.